The Cow-Tipping Point

December 29, 2020 - 4 min read

Cultivated ground meat has the potential to unravel the business model of the beef industry

Price parity for cultivated beef to compete with factory farming is an aspiration for the future of the industry. Many entrants expect cultivated meat to go to market at a price premium and target early adoption by consumers who value the social impact and health benefits of the product. In December of 2020, Eat Just’s chicken nuggets, the first cultivated meat product ever sold, were priced at US$23 per order in a Singapore restaurant.

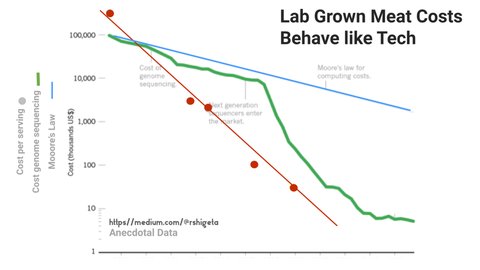

Pricey, but the cost to produce cultivated meat is falling rapidly. In 2013, Mark Post famously produced the first cultivated burger for approximately $300,000. Since then, the cost has dropped by 6,000 times and now stands at around $50 per serving. As described by biotech investor and entrepreneur Ron Shigeta, this cost reduction is happening at a faster rate than both Moore’s law for transistor/software technology and human genome mapping.

Factory farmed beef historic trends, as described in year-over-year inflation adjusted retail beef prices by the team at Wildtype, show increasing prices since efficiencies and economies of scale reached their peak in the late 1990’s. More recently during Covid-19, shocks to the supply chain have caused massive changes in prices for beef consumers. Coupled with the fact the industry isn’t nimble enough to turn supply up or down — cattle take up to two years from birth to slaughter — legacy beef is vulnerable to a competitively priced substitute.

Beyond Meat and Impossible Foods have already demonstrated consumers are willing to consider different plant-based options for their burgers. McDonald’s has recognized the trend, and is in the process of rolling out the McPlant burger line. However, despite the success of these products, they have been unable to significantly curtail the demand for traditional ground beef.

Enter the cultivated burger. As a true muscle and fat composition product, cultivated ground beef will have an opportunity to build on the momentum of changing consumer preferences and capture holdouts who haven’t hopped on the plant-based bandwagon. The industry expectation is that cultivated meat will appeal to consumers for the quality, animal welfare considerations, environmental impact, and health advantages of these new products.

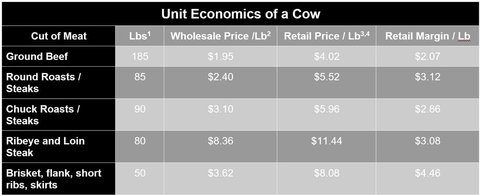

Retailers and wholesalers will likely be affected by this entry, inducing a ripple effect across the supply chain for all factory-farmed beef products. Ground beef accounts for 21% of beef revenue for wholesalers and 25% for retailers. To maintain margins on these revenues, a long-term decrease in demand for ground beef would result in price increases for the major structured cuts — round, chuck, ribeye, and loin roasts/steaks. If cultivated ground beef is successful, this impact will likely be felt well before a cultivated steak is ever on the menu.

- SDSU Extension; 2. Beef. It’s What’s For Dinner. Wholesale Price Update (Dec. 11, 2020); 3. BLS (Nov. 2020); 4. USDA

To illustrate, consider a simplified “one-cow” world of a single wholesaler selling one cow carcass to one grocery retailer. The current expected marginal revenue for the grocery store is approximately $1,375. Breaking this down by cut, ground beef accounts for nearly 40% of the meat by weight and 28% of the marginal revenue for the grocer.

Note some assumptions of this scenario are that consumers choose cultivated over legacy ground beef in a one-to-one switch, and the ground beef price is not reduced to maintain market share. Although a simplification, ground beef has the smallest margin of any beef product and can’t be reduced below about $2 before it is sold at a loss. There are methods to add fillers and non-cuts of meat to lower the cost, but this will also result in a reduction of quality, further eroding the value proposition to consumers.

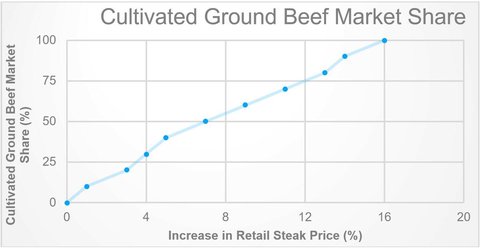

This shift in preference will result in gradual price increases of other major cuts of beef in the one-cow example. Achieving 20% market share for cultivated ground beef would drive a 3% increase in prices for factory farmed steaks. Over time, consumers could see a massive 16% increase in the price of steaks. This is additive to price increases previously described by Wildtype due to supply chain issues and overall costs of legacy factory farming for beef.

Although it’s unclear if and when cultivated meat will break the business model for factory farming, it has a clear advantage as a technology that can meter supply on the order of weeks instead of years and deliver a higher quality product against an incumbent with few response options. The beef industry cannot assume they will command a price advantage for long with their production costs increasing, cultivated meat prices continuing to decrease, and consumers weighing in on their quest for a better burger.