Plant Protein Sector Shows Resilience Amid Rising Costs, Labour Challenges, and Shifting Investment Drivers: Q4 2024 Industry Survey Results

December 9, 2024 - 7 min read

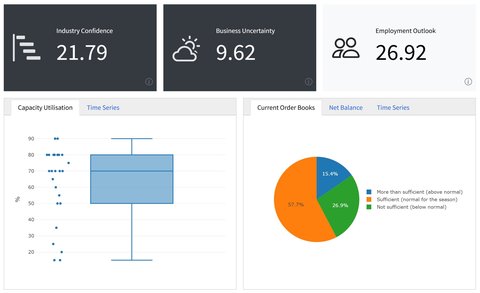

Amsterdam, December 9, 2024 – The global plant protein sector experienced increased production activity in Q3, accompanied by growth in orders and a 70% median level of capacity utilisation in early Q4. Input costs rose for many firms, but selling prices remained relatively stable, reflecting competitive pressures to improve efficiency, offset rising costs, or accept tighter margins. Labour costs were also reported to have increased, yet hiring continued modestly, despite challenges in finding skilled workers. The sector’s investment outlook for 2025 indicates a shift toward demand-driven priorities, signaling confidence but possible easing in technology-driven upgrades.

The latest figures were released today as part of an industry reporting and intelligence framework, funded by the European Union and hosted by Netherlands-based Bridge2Food Research. Full details for this data period have been published in an open-access data dashboard accompanying this release summary.

Production & Orders

Production grew across the plant protein sector in Q3, with 77% of managers reporting increased production and 73% expecting continued growth in Q4. The median level of capacity utilisation was 70%, indicating healthy order books, which were reported to have increased in Q3 by 77% of managers. However, order books in early Q4 were mixed, with a net balance of -11.5 showing orders below normal seasonal levels for some producers.

Current stocks of finished products were reported to be adequate by 89% of managers, indicating that most producers are not struggling to keep up with demand. However, the net balance of -3.9 indicates stocks below normal seasonal levels and possible inventory challenges for some firms.

Production capacity was not a major constraint for most firms in Q4. The net balance of 11.5 indicated capacity to be mostly sufficient across the sector, with low prevalence of surpluses or shortages in capacity. Instead, the primary factor limiting production was demand, followed by uncertainty about economic policy.

Inputs & Prices

Input costs (excluding labour) were reported to have increased by 62% of managers in Q3. Despite these rising costs, selling prices remained largely unchanged – only 27% of managers reported increased selling prices, with the net balance of 15.4 suggesting some producers accepted lower margins or implemented other measures to offset rising input costs.

Expectations for Q4 showed continued increases in input costs but less willingness to absorb or offset those increases: with 58% of managers expecting increased input costs in Q4, 35% expected their selling prices to increase. This low elasticity of selling prices in response to increases in input costs highlights the competitive nature of the market and suggests the adoption of cost-reducing innovations, substitutions, or other practices to offset rising expenses.

Labour

Labour costs increased for 50% of reporting firms in Q3, putting further pressure on selling prices and profit margins. Despite these cost increases, hiring continued modestly across the sector, as staff numbers grew for 35% and fell for 8% of reporting firms. The employment outlook for Q4 showed modest continued hiring, although most firms expected staff numbers to remain unchanged toward the end of the year.

Labour costs across the plant protein sector were perceived to be normal by 69% of managers while 27% perceived them as high. However, finding sufficiently skilled labour was a challenge reported to be difficult by 58% of managers, indicating a sector-wide shortage of skilled workers. These figures highlight the need for targeted education and training programs to address skill gaps in the industry.

Investment & Innovation

Total investments in Q3 were reported to have increased by 62% of managers, primarily in machinery and equipment. Although net-positive increases were also reported for investments in infrastructure and nonphysical capital, increases in those categories were not as widely reported.

Annual survey data for Q4 show that 2024 saw increased investments across the plant protein sector, with 54% of managers reporting greater total investment than in 2023 and only 4% reporting decreased investment. Investments focused mainly on capacity expansion and production optimisation, primarily driven by technical factors, such as impacts of technological change and the need to upgrade equipment or skilled labour resources.

Expectations for 2025 indicate a continued trend of increased investment, although to a lesser degree than in 2024, with 12% of managers expecting decreases in investment activity. Planned investments for 2025 remain focused on production capacity and optimization, however demand is now the primary driver, replacing technical factors as the leading motivator for investment.

Positive net balances for investment activity suggest overall confidence within the plant protein sector, while the shift in investment drivers indicates that some firms have completed production upgrades in 2024 and are now moving towards a demand-driven investment strategy for 2025.

About the Data

The 2024-Q4 data release includes figures from 26 firms spanning four segments of the plant protein supply chain:

Producers of plant-derived meat substitutes

Producers of plant-derived dairy substitutes

Upstream suppliers to producers of plant-derived meat, dairy, and egg substitutes

- Suppliers of primary ingredients (e.g., soy protein, pea protein, oats)

- Suppliers of secondary ingredients (e.g., flavour, fragrance, texture)

In each segment, participating firms include some of the largest in their industries, accounting for considerable portions of products in markets, input utilisation, and labour in the sector. Small and medium-sized businesses (SMBs) are also represented, providing insight into the market dynamics of producers without the benefits of economies of scale but often with greater operational agility.

“While it is up to each firm whether to disclose their participation in the framework, we can confirm that participants represent a significant global market presence,” said Vincent Brain, General Manager at Bridge2Food. “For plant-based meat and dairy, this includes firms with leading distribution in retail and foodservice across Europe and the United States. For ingredient inputs, it includes some of the largest global suppliers of primary and secondary ingredients.”

For firms with diversified operations beyond the plant-derived meat, dairy, and egg substitute industries, managers were asked to provide data specific to their business targeting those sectors only. It is also important to note that the current period’s data are aggregated without weighting for firm size, meaning most figures in this release represent the prevalence of changes taking place across the sector rather than their magnitude.

“If we consider factors such as firm size, it is possible, though not trivial, to estimate a statistically representative sample,” added Vincent Brain*. “This is part of ongoing work to refine our methodology, which will include providing weighted and seasonally adjusted data in future releases*. In the meantime, these figures offer the first comprehensive macroeconomic insights into this sector.”

The latest data period saw high representation from firms targeting European markets, which accounted for an average of 49% of regional sales distributions, while US & Canada accounted for an average of 29%. This is likely due to greater regional recognition of the framework’s EU funding and its Netherlands-based host organisation. Nonetheless, participation from US and Canadian, Asian, and Oceanian firms was also considerable in both numbers and shares of their regional markets.

About the Framework

Following methodologies used by the European Commission’s Directorate-General for Economic and Financial Affairs in their surveys of industry, this industry reporting and intelligence framework was established to address the shortage of reliable figures on the status and outlook of the plant protein sector.

“Our goal was not only to understand what is happening in this space beyond the anecdotal and sometimes questionable data currently available,” explained Vincent Brain. “By establishing this framework, we aim to elevate the sector to a level of maturity where reliable industry figures are available for policymakers, managers, investors, and researchers.”

At the start of each quarter, firms across the plant protein supply chain are invited to participate by providing a series of high-level, non-sensitive business metrics through a simple 10-minute questionnaire. Participating firms gain pre-release access to aggregated industry data and summary reports, as well as detailed data breakdowns and special reports, among other benefits.

The industry reporting and intelligence framework has received funding from the European Union’s Horizon Europe research and innovation programme under the Giant Leaps grant agreement No 101059632, and is hosted by Bridge2Food Research – the industry intelligence and science communication arm of Bridge2Food.

Learn more about the framework at research.bridge2food.com.

About Bridge2Food

Bridge2Food is the Netherlands-based producer of global summits, meetings, and training courses focused on the sustainable food and protein industries. For over 20 years, Bridge2Food has been building professional communities and leading multidisciplinary gatherings to identify key food industry challenges and facilitate solutions. Learn more at bridge2food.com.

About GIANT LEAPS

GIANT LEAPS is the Horizon Europe-funded research project delivering strategic innovations, methodologies, and open-access datasets to accelerate the shift toward more sustainable and healthy food systems. Bringing together 35 partners from 13 EU member states and four associated and affiliated countries (Canada, Serbia, Switzerland, United Kingdom), the GIANT LEAPS consortium works in line with the Farm to Fork Strategy and European Green Deal target of reaching climate neutrality by 2050. Learn more at giant-leaps.eu.